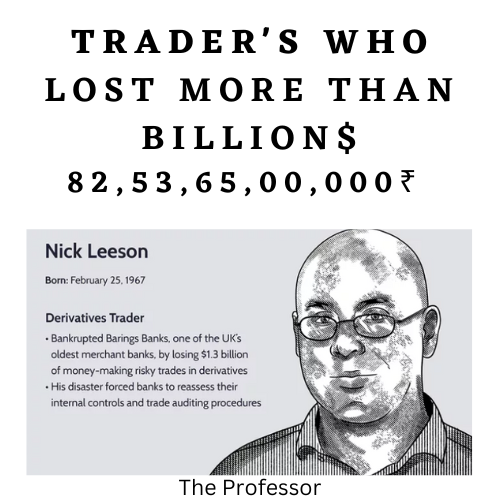

Short stories of 5 traders who lost more than a billion $ and losses big enough to screw banks.

Nick Leeson

Nick Leeson is a British trader who was responsible for the collapse of Barings Bank in 1995. He was hired by Barings Bank to manage their operations in Singapore. Leeson started to take speculative positions on the Tokyo Stock Exchange and lost a substantial amount of money. To cover his losses, he made a series of unauthorized trades and engaged in fraud. In total, Leeson lost over $1.3 billion, which led to the bankruptcy of Barings Bank.

Jerome Kerviel

Jerome Kerviel is a former trader at Société Générale who was convicted of breach of trust, forgery, and unauthorized use of computers. In 2008, Kerviel made a series of unauthorized trades that resulted in losses of €4.9 billion for the bank. Kerviel was sentenced to three years in prison and ordered to pay back the losses he caused.

Brian Hunter

Brian Hunter was a natural gas trader at Amaranth Advisors LLC. In 2006, Hunter made a series of speculative bets on natural gas prices that went wrong, resulting in losses of over $6 billion for the hedge fund. The losses were so significant that they caused Amaranth Advisors to collapse.

Jesse Livermore

Jesse Livermore, like many traders, experienced both great successes and failures in his career. One notable failure occurred in the early 1930s when Livermore became convinced that the stock market was due for a major correction.

In 1929, Livermore had correctly predicted the market crash and made a fortune by shorting stocks. However, in the years that followed, he continued to hold a bearish view on the market, despite signs of recovery.

Livermore began shorting stocks again in 1932, but the market continued to rise, and his losses began to mount. In an attempt to recoup his losses, he began making increasingly risky trades, using margin to increase his leverage.

Unfortunately, Livermore’s bets did not pay off, and by 1934, he had lost most of his fortune. He was forced to declare bankruptcy and sell off his assets.

Livermore’s failed trades in the early 1930s serve as a cautionary tale about the dangers of stubbornly holding onto a losing position and the importance of managing risk in the world of finance. Despite his losses, however, Livermore remained an influential figure in the trading world and his trading strategies and philosophies continue to be studied and analyzed by traders today.