If you are a heavy trader you should definitely read how you can save more than 2-3 lakhs every year.

The entire article will consider that you punch an average 10 orders in a day i.e. 10 Buy and 10 sell orders.

Majority of discount brokers in India namely Zerodha, Upstox and Dhan are charging 20 Rs per order as brokerage.

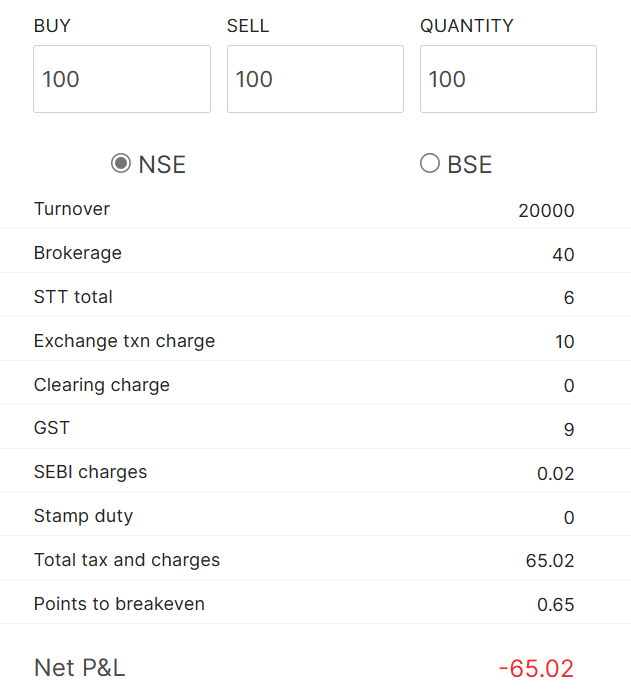

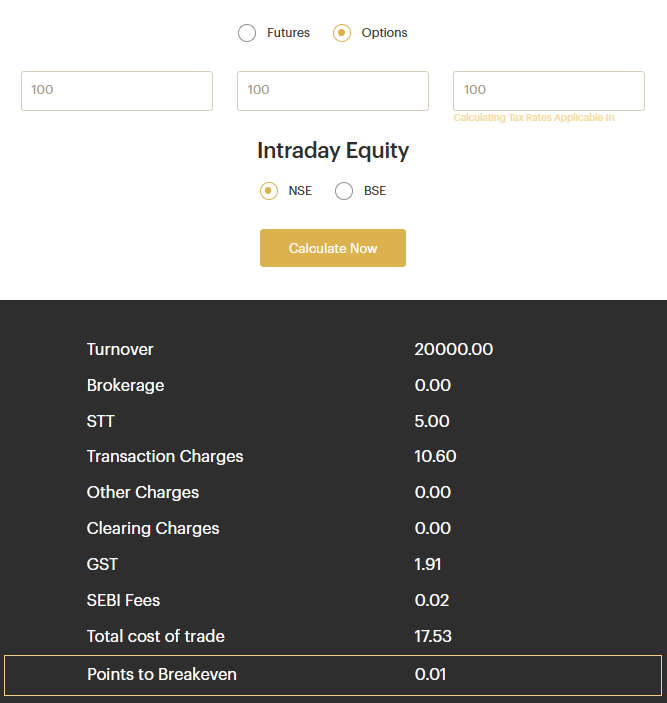

If a user buys 2 lot NIFTY and sells 2 lot NIFTY at same price with Discount brokers the Brokerage and other charges

Brokerage and other charges in Discount brokers for 2 lot NIFTY

Brokerage and other charges with Free Brokers

An average trader punches 10 buy and 10 sell trades in a day so the brokerage is 73% more with Discounted brokers in comparison to Free Brokers. In above scenario you will pay 1300 ₹ in Zerodha while 350 ₹ with Finvasia or Mstock.

Now even after so much savings why people still continue to use the Discount brokers ?

Once bitten, twice shy these free brokers are new in this market, their applications are not up to the mark.

Big players are OK to pay a premium rather than being a victim of app crashes and lose in lakhs. In its initial days these discount brokers also saw several crashes which has now improved a lot but eventually the traditional brokers gave up and the mass shifted to using Discounted brokers.

Will the Free Brokers replace Discount Brokers?

Rather than saying free brokers would replace the Discount brokers sensing heat the Discount brokers will become Free brokers like Robinhood in US which earns from different sources.

How do the Free Brokers make money then ?

- Interest on uninvested cash: When users transfer money into their account but do not invest it immediately, The apps would place that money in an interest-bearing account and earns interest on it. The brokers keeps a portion of this interest and pays the rest to the users.

- Securities lending: These brokers can lend out stocks from users accounts to other investors who want to short those stocks.

- Different fees: The brokerage charges fees for certain services, such as transfer and withdrawl fees with Annual Maintenace charges and Dmat charges along with account opening fees.

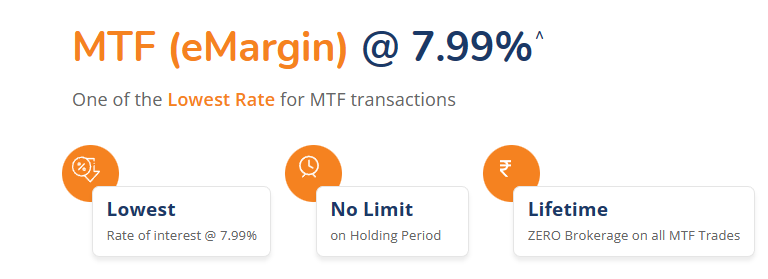

- Margin Trading: The biggest source of income for these companies is Margin Trading Facility

- Volume Benefits: Exchange Benefits the broker for higher volumes.

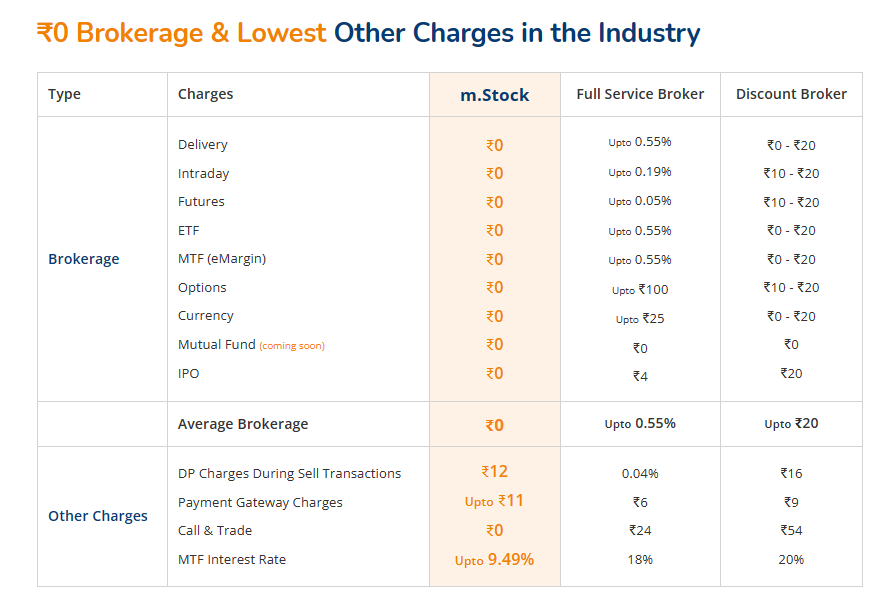

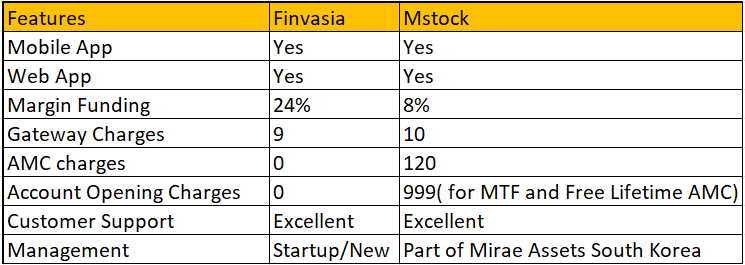

Now after going through the article and have plans to opt for a Free Broker and save some money here is a comparison of Free Brokers in India specifically Mstock and Finvasia. Did not consider Kotak because it allows free brokerage for traders less than 30 years of Age.

I have used both of them, started with using Finvasia and currently I use Mstock both have their own pros and cons. My only reason for using Mirae it was a much reliable brand with offices all over India and the customer service was far more professional. But both of them are yet miles to reach the benchmark set by Zerodha for UI and execution.

Referral Links in case you are interested